RESEARCH AT THE RSIT

The RSIT conducts research on policy-relevant topics in international taxation and cross-border activities of multinational companies. Below you will find a short summary of the most recent research projects. Please click on the right to get a full list of our publications and to download papers from our working paper series.

Recent Studies

The ITI Database: New Data on International Tax Institutions

This article introduces the new International Tax Institutions (ITI) database, a unique attempt to collect the most relevant statutory tax indicators for the whole world. It includes taxes on corporate and personal (earned and capital) income, consumption taxes, as well as antitax avoidance rules (thin-capitalization and earnings-stripping rules, CFC rules and transfer pricing regulations). Our main objective is to provide a broad overview on key features, (time- and cross-sectional) variation, and regularities in the data, with a focus on international tax issues. We present a vast number of new variables – such as effective tax and institutional measures – that allow for a comprehensive description and comparison of countries’ taxes and tax systems.

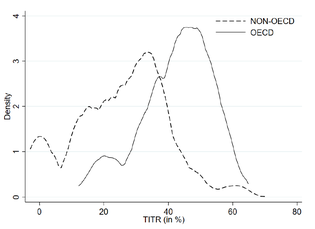

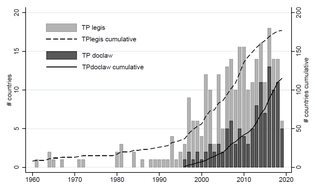

Transfer Pricing Regulations Worldwide: A Survey

Transfer pricing (TP) regulations have been introduced in the domestic tax laws of 177 countries by the year 2019. This paper provides a survey on TP regulations worldwide for the years 2001 to 2019. First, the paper provides a descriptive overview on the dataset, which includes variables on the years of introduction of TP regulations as well as 40 variables on different provisions in TP regulations. We then perform a pooled cluster analysis on our TP panel dataset to find out how TP regulations have evolved across countries and over time. Finally, we analyze the determinants of bilateral dissimilarity in TP regulations across countries and over time in a regression framework. We find that bilateral trade and income levels are explain similarity in TP regimes across countries. Other geographic and cultural proximity indicators also play a significant role.

Identifying tax-setting responses from local fiscal policy programs

This paper provides a survey on personal (earned and capital) income taxes around the world. We first describe our newly collected tax dataset, covering 165 countries, 11 tax measures, and 10 years. We then show how income taxes correlate with different country-specific characteristics. Among others, we show that higher income taxes are associated with lower GDP growth and income inequality.